During my freshman year, I ventured out into the French Quarter with a group of friends to see the Krewe of Boo Halloween Parade. After clamoring to catch as many beads, cups, and hats as we could, our group moved to a side street to await our Uber back to campus. While sitting on the curbside, we were approached by a man with tired eyes but an exaggerated grin. He looked somewhat elderly and unkempt, with sweat glistening on his dark brow and fancy beads weighing down his neck. We responded to his questions with detached politeness as he complimented our beads and asked about who we were and why we were there. He lifted some of his fancier beads from around his neck and placed them around the neck of my friend Kian, who smiled uncomfortably, unhappy about being the focus of this man’s attention.

As our car pulled up, we thanked the man for the conversation and the beads, and his response made his true intentions clear: “Could I… Could I have a couple of dollars?”

“We don’t have any cash, we’re sorry,” said Kian with an apologetic look, sheepishly toying with the beads around his neck. It was true; in this digital age, we all relied on debit cards and Venmo to keep our funds safe. Perhaps the man didn’t believe us, or perhaps he was frustrated at the waste of time, but his expression immediately turned sour.

“Oh. Then I want my beads back.” He bit out this retort aggremptuously (that is to say as if each word dripped with venom, said with contempt to the highest degree). Kian immediately lifted the beads from his neck and placed them back in the man’s outstretched hand, stammering out apologies as we all ducked inside our waiting Uber.

In every major city in the world, there is a street economy — costumed characters in NYC charging for photos, individuals giving politically-charged rants with a donation bucket at their feet in Washington DC, or native New Orleanians trading beads for cash. However, residents of Louisiana may feel that this is their only option, as the minimum wage in New Orleans is incredibly low compared to other major US cities. Unskilled individuals searching for entry-level jobs in New York City stand to make $15 per hour. Conversely, Louisiana’s minimum wage is $7.25 per hour, which is the absolute lowest that the federal government mandates it can be. It’s important to note that this $7.25 per hour drops to the absurdly small $2.13 per hour if you’re an individual who relies on tips, like a bartender or a waiter (4). Other states and cities have raised their minimum wage to upwards of $14 per hour, over twice the Louisiana rate. The minimum wage has been increased in 29 states, as well as D.C. since January 2014, and Louisiana is not one of them. Some may argue that the cost of living in other places with a higher minimum wage, like California, is proportionately higher, justifying this minimum wage gap, but in the heart of New Orleans, rent can be exorbitantly high. (7).

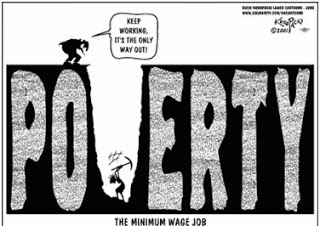

This cartoon portrays a man working a hard labor job who seems to be living and trapped in poverty, while his boss watches from afar.

In Louisiana, the average rent price for a two-bedroom apartment is $1405 per month, a number that likely rises as one moves closer to the urban center of New Orleans. In Washington DC, where minimum wage workers earn a respectable $14 per hour, the average rent price for a comparable two-bedroom apartment is $2750 per month (1).

While a person in New Orleans could slave away at their job, put in 60 hours per week, and make $1,740 per month, a person in Washington DC could work the same hours and make $3,360 per month. The New Orleanian worker doing the same job for the same amount of time will only have around $300 left over for food, clothing, healthcare, bills, and countless other necessities per month after paying rent, while the worker in Washington DC will have double that amount left over. While both minimum wage workers in this example struggle to afford the rent for the average two-bedroom apartment, the New Orleanian worker finds themself worse off for putting in the same amount of work as the Washington DC native. (1).

Contrast of Cultures: Traditional Festivity in Front of Weathered Housing

To take this analysis a step further, we can observe living wage trends in other sectors of the country compared to New Orleans. A living wage can be defined as a wage “high enough to maintain a normal standard of living.” Living wage calculations do not factor in any sort of leisure costs, from entertainment to dining out; it’s the bare minimum wage required to care for all basic needs of a family. Although the “eroding real value of the minimum wage has led to a movement throughout the country for legally mandated “living wage” floors,” Louisiana has not acted in favor of establishing a living wage (5). According to MIT’s Living Wage calculator, which calculates a realistic living wage for differing household sizes in different cities, the living wage for a single parent working full-time with two children in Louisiana is $27.68, 3.82x the minimum wage rate. Conversely, in Washington DC, the living wage for a single parent working full-time with two children is $33.58, which is 2.4x the minimum wage rate. The gap between New Orleans’s minimum wage and its estimated living wage is disproportionately high, which speaks volumes about the current effectiveness of minimum wage levels. A worker in New Orleans would need to seek out a job that pays almost four times minimum wage to enjoy the same standard of living as an individual in Washington DC, who would need to find a job that pays only 2.4x minimum wage. This would seem to suggest that the average worker in New Orleans would have to make an effort to be more educated than the average worker in Washington DC, or else their job opportunities would be seriously limited (2).

Across the country, several organizations dedicate themselves to ensuring that workers in their area enjoy a sufficient living wage. The Living Wage Network is an umbrella organization that encompasses several regional living wage companies, such as in Orange County or Western Mass. The Living Wage Network is a certification program that recognizes employers and businesses that choose to pay their employees a fair wage. Their website gives three pillars of why companies choose to certify as a living wage company: living wages are proven to benefit workers by giving them the ability to adequately provide for themselves and their families, by promoting economic growth through placing more spending power in the hands of the consumer, and by benefitting the employers themselves, as implementing a living wage has been proven to increase worker morale and health, as well as improving quality of service (3). Over 2,500 small and medium-sized businesses across the country have certified their pledge to pay their employees a living wage through this network.

It is worth noting that it is not financially feasible for small businesses to pay each of their employees a living wage. This is a costly practice; if it were affordable, every business would pay their employees a living wage. However, the businesses that have adopted this certification have reported all of the benefits to workers that the website pledges to bring. The benefits of a solution like this would not just be economic. As discussed in the article titled “Creating Connections: Solutions to youth suicide in La Plata County,” a feeling of connection and belonging is shown to lower rates of suicide, depression, and anxiety (7). If minimum-wage workers are paid a living wage by their employer, it sends them the message that they are a valuable asset to this business and not simply an expendable minimum-wage workers. This strengthens the bond between business and employee while boosting the confidence of these employees as well.

Native New Orleanians who rely on minimum wage jobs would have their lives changed by the implementation of a living wage, as minimum wage in New Orleans is nowhere near what is considered a livable wage, and the benefits of instituting a living wage have been proven through projects like the Living Wage Network. Though state-wide reform is unlikely, businesses can take it upon themselves to make changes for the good of their employees. Small-scale change is the first step on the path to sweeping reform.

WORKS CITED:

NOLAbeings

Multimedia artist Claire Bangser created NOLAbeings as a portrait-based story project that marries...

NOLAbeings

Multimedia artist Claire Bangser created NOLAbeings as a portrait-based story project that marries...

Data corner: Adobe Suite (create a PDF, social media graphic, presentation, edit a photo and video

Data corner is where you go to work with analytics and top tech skills. It takes on everything from PERL and SQL to Canva and Sprout Social.

Data corner: Adobe Suite (create a PDF, social media graphic, presentation, edit a photo and video

Data corner is where you go to work with analytics and top tech skills. It takes on everything from PERL and SQL to Canva and Sprout Social.